Frequently Asked Questions.

General

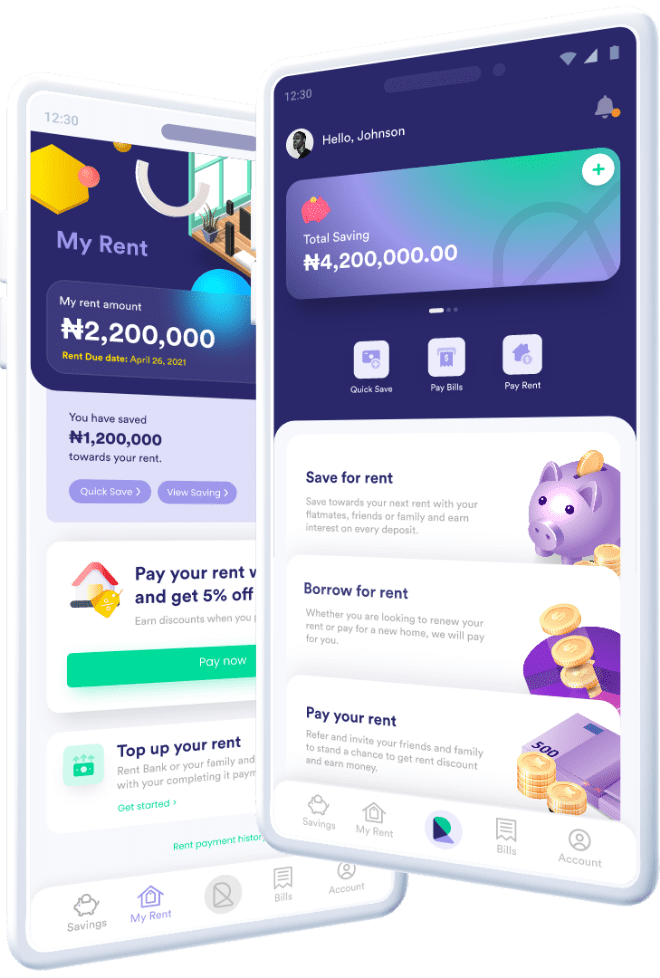

A digital platform that helps Africans facilitate rent payments by creating flexible saving and financing payment options

For Nigerians, your BVN is required to authenticate identity and to protect you against fraudulent activities.

Any renter or aspiring homeowner can use Kwaba.

Your repayment plan can be between 1 to 12 months.

As long as you work, have a clean credit history and above 21 years, you are eligible.

No. We finance all rental properties, both listed and not listed on our platform. We can help renew the rent of your existing accommodation or pay for that new house on your behalf.

Residents of Lagos, Abuja and Port-Harcourt can use our rental finance feature

Yes you can. Our customer care lines are open from Monday to Friday, 8am - 5pm. Give us a shout on +234 901 8112914.

Savings

Yes, your savings are safe as they are insured by NDIC and secured with bank-grade security features. We work with PCIDSS compliant payment processors to ensure your money and data is safe and fraud-proof.

You get 7% interest per annum if your savings plan is unlocked and 8% interest per annum if your savings plan is locked.

As long as you have a rent goal to achieve, you are eligible to save on Kwaba.

Yes you can but only if you select “unlock” savings when beginning your saving plan. If you select to lock your savings, for discipline purposes, you won’t be able to get your money until the set withdrawal date. Not to worry, you can use our instant loan feature if you need emergency cash.

Yes. All you have to do is go into your dashboard to update your change and Kwaba would update accordingly.

If you opt for the option of automatic withdrawal from your bank, then yes, you would have to sync your bank account to your Kwaba app. However if you prefer the option of manual transfers to your Kwaba app, no synchronization would be necessary.

Saving with Kwaba opens a world of financial possibilities for you like:

- Getting access to instant loans when you have emergencies

- Getting rental loans when you can’t meet up with your rent payment.

- Earn high interest on your savings

- Build the discipline needed to be financially successful

Kwaba accepts all debit cards

You can begin saving with a minimum of one hundred naira (N100). We have no upper limit.

Your savings start to earn returns or interest the day after you start saving on Kwaba.

Emergency Funds

Kwaba emergency fund helps Kwaba rent savers access instant loans without touching their rent.

Once you are an active saver on Kwaba, you can access emergency funds.

You have to pay back in 30 days.

Emergency funds are limited to just Kwaba savers.

Rent Now, Pay Later

Your BVN is required to authenticate identity and to protect you against fraudulent activities.

Kwaba ensures that your rent is paid within 48hours of receiving all your supporting documents

You can manually upload your bank statement if you have it handy or securely connect your bank account on our app or website via trusted 3rd party platforms via your mobile/internet banking app.

Your repayment plan can be between 1 to 12 months. We always recommend a 6 months payment duration

As long as you do not have any bad loans and you have a consistent stream of income, you are eligible.

No. We finance all rental properties, both listed and not listed on our platform. We can help renew the rent of your existing accommodation or pay for that new house on your behalf.

Residents of Lagos, Abuja and Port-Harcourt can use our rental finance feature. We are fast expanding and will be in more cities soon.

Yes you can. Our customer care lines are open from Monday to Friday, 8am - 5pm. Give us a shout on +234 901 8112914.

Kwaba has just 2 basic requirements: Your bank statement for the last six months and a valid government issued identity card. All these can be conveniently uploaded on our website or app.

Your bank statement can be generated from your online banking app. You can also send an email to your bank to request your bank statement.

Your income amongst other factors determines your pre approved amounts.

Yes, you certainly can. Reach out to your correspondent or call our customer service line: +234 901 8112914 to get the process of repayment started.